Mortgage Calculator for a Switzerland Bank

by

Mifort

About

CHALLENGE

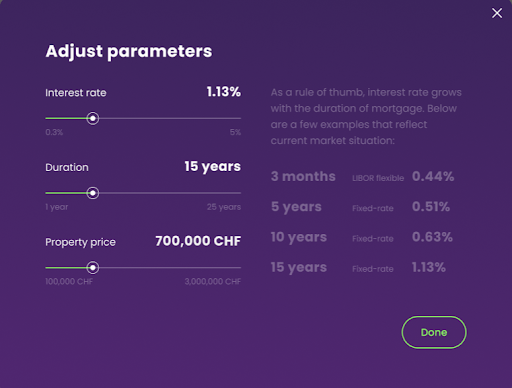

To develop a desktop and mobile mortgage calculator that gives advice for expats in Switzerland.

SOLUTION

The architecture of Online Mortgage Advice was implemented using the advantages of the new version of Angular 9. Faster testing and improved debugging made it possible to save the testing time without sacrificing quality. We have used modern frameworks and technologies to provide best service for the client.

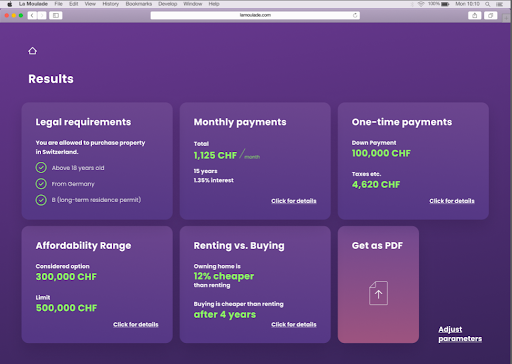

Switzerland has strict rules about foreign nationals purchasing real estate. MIfort Developers created 20 filters that make analytics and follow the rules. Some options can be limited depending on the country of origin and length of stay in Switzerland. And, for instance, In Switzerland, you must pay at least 20% of the property price on your own. At least 10% of this must be paid for in cash and you can use your retirement savings for the remainder. The developed calculator finds out whether an expat qualifies for the mortgage or not.

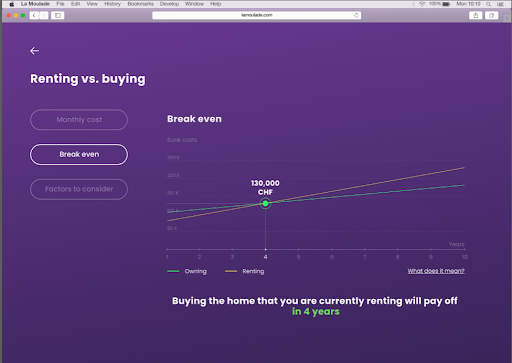

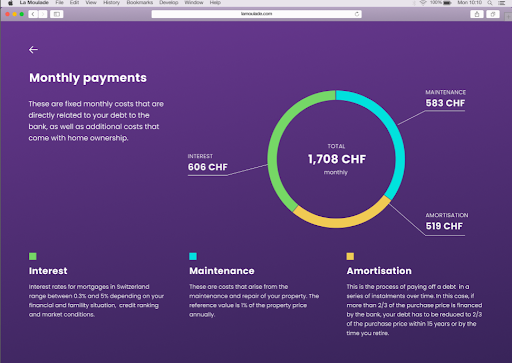

Our team developed various types of charts for data analytics (bar charts, donut charts, etc). Developed features show users more than 10 different graphs in D3.js.

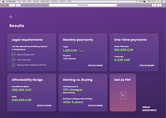

We implemented functionality of downloading reports in PDF format that contains information on legal requirements, monthly payments, one-time payments, affordability range, renting vs buying etc.

We also have implemented integration with Google Analytics and Tag Manager that allows the Client to analyze User behavior. Besides that we have setted up Mailchimp to send PDF reports in emails.

In that way, we have created the Desktop and Mobile online advisor for the Switzerland Bank. Any User with built Mortgage Calculator can help quickly and accurately predict monthly Mortgage payments with just a few pieces of information.

Built Advisor Application is used by more than 1000 people every day, and it is expected to have 10000 people a day in the near future with the help of advertisements and marketing.