Visa

by

nullgravity

About

Scan to Pay by Visa is a universal SDK solution for any Visa partner applications. It helps consumers and businesses perform transactions. P2P money transfers in apps are made using native support of QR-code scan on mobile devices.

Briefly

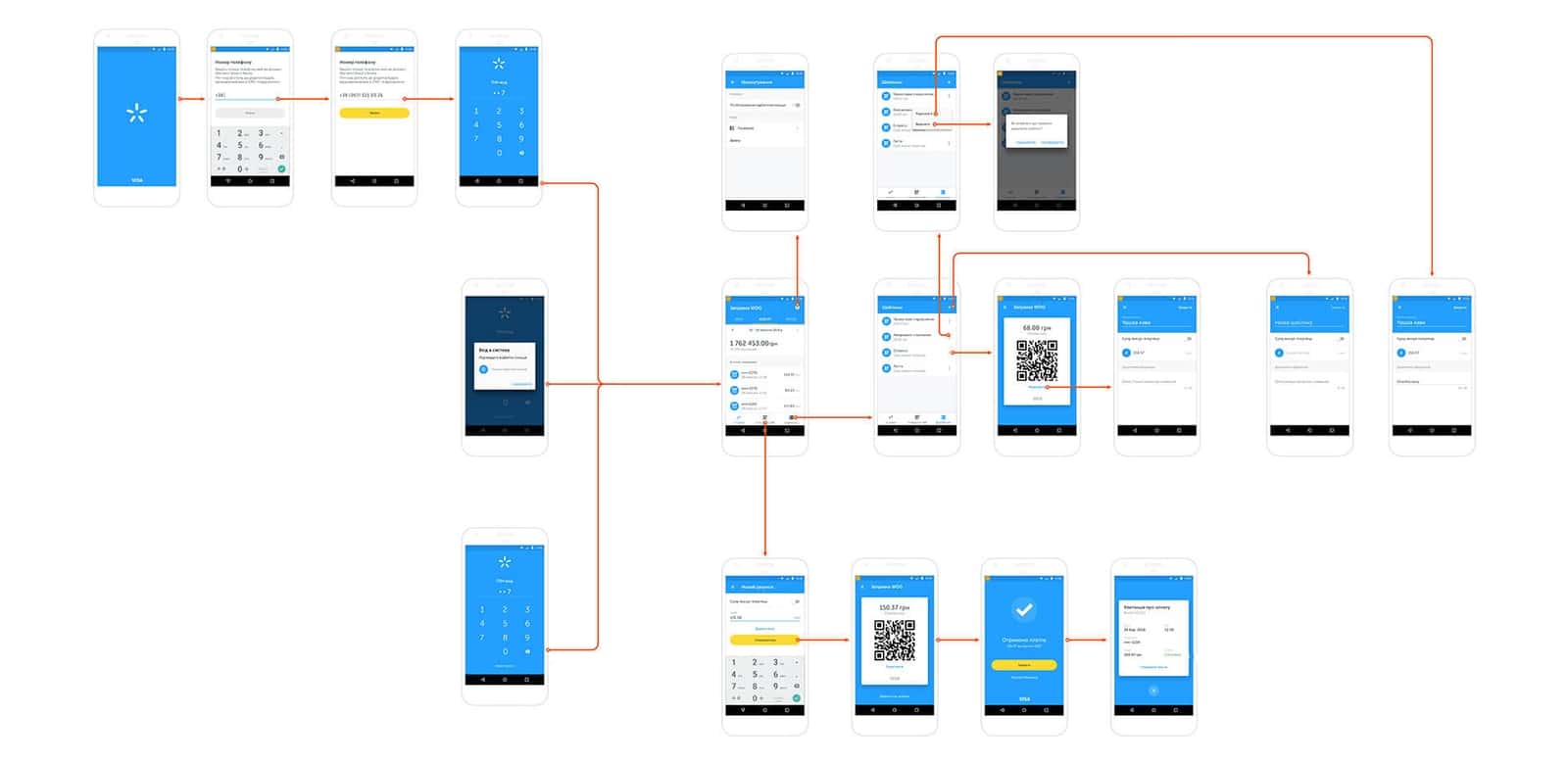

Scan to Pay by Visa is a QR based payments solution that helps send payments directly from the Visa prepaid debit or credit card account to all kinds of merchants and businesses using just a phone. We were working on the development of an ecosystem of two applications: Merchant App and Consumer SDK. Merchant App application is intended for sellers, and Consumer SDK is for buyers. Applications should provide convenient and secure use of mobile transactions both for companies and for individuals. Moreover, the payments had to be implemented using QR codes within the mVisa technology.

Challenge

Usually, the companies dealing with payment systems have lots of vendors, and this project is not an exception: mobile applications have to meet the needs of different companies because the client works with both the largest European retailers and small HORECA companies. Lots of stakeholders, different goals, very little time. We had to fulfill the needs of end-users that don’t want to pay with cash (that’s one!). Small HORECA-companies, that can’t afford payment terminals, and therefore a mobile solution would fit perfectly — that’s two!

Communication process

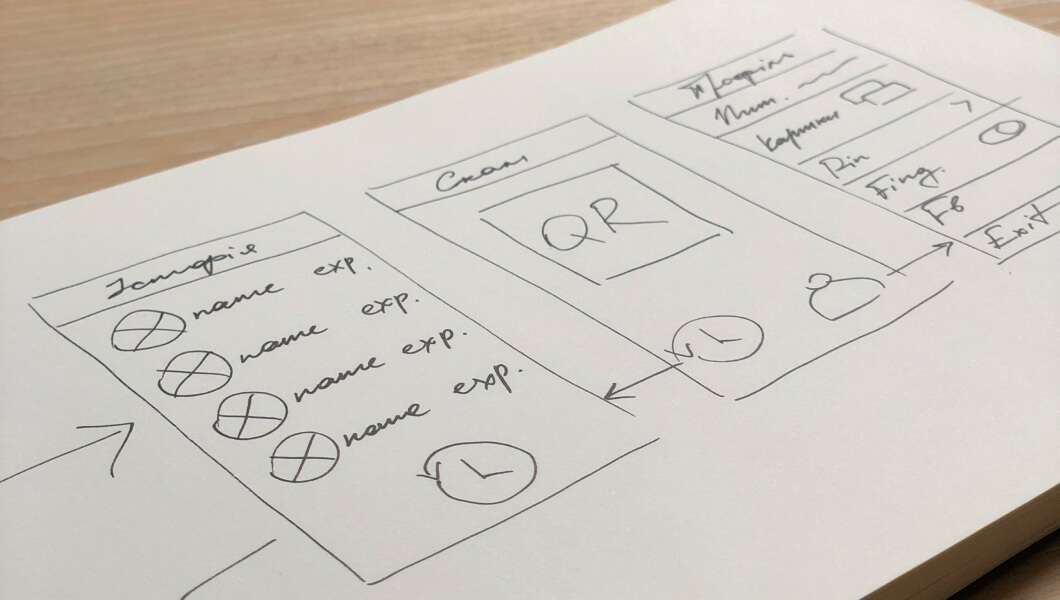

To speed up the decision-making process, we didn’t just invite key representatives of business departments to all meetings, but also representatives of the technical team. Because of that, we were able to close several stages of product development with one meeting. While presenting detailed prototypes of interfaces, we discussed both business needs and technical details of the implementation, even though such details are usually thought through during the development process.

Merchant App

While working on the interface design, we implemented Visa guidelines and combined them with the best local practices and patterns. Local solutions helped us understand the patterns and flows that are familiar to users in the application, at the same time we cut off the cases that wouldn’t work on the Ukrainian market. While designing the Merchant App application, we implemented the needs of both large retailers and small retail chains — beauty salons, coffee houses, and diners. Having a variety of feedback, we compiled and prioritized the backlog, estimated by three criteria: importance for end users, importance for business, complexity of implementation.

Consumer SDK

While working on the Consumer SDK, we had to make sure that the interface will be simple, easy to use and secure. Decades will pass, and the main values of any financial service will remain safety and security: all processes must be transparent, all patterns are clear, the possibility of accidental errors is minimized, the security of personal data and user account are carefully worked out and tested.

Results

More than one-third of sales of major retailers come from smartphones, and young adults are using smartphones as the main gadget for online shopping. Creation of mobile application was a logical task for a retailer. Started in 2016, we have come a long way together with an amazing Leroy Merlin team. We had created a new product strategy and an excellent user experience for the largest European DIY retailer. And we still have lots of versatile and ambitious plans. Stay tuned.