Raiz InvestRaiz Invest

by

Onix-Systems

About

About Raiz Invest Company

Raiz Invest Limited, or simply Raiz, is Australia’s largest mobile-first savings and investing platform.

The company was founded in 2015 as Acorns Australia, the local arm of the US-based micro-investing platform Acorns. Around the same time, Richard Brookes, now the CTO of Raiz, who had once dealt with Onix, recommended our team for building a modified version of Acorns for the Australian market.

Thus, in early 2016, the first of its kind mobile-led, consumer-focused financial services platform was launched, pioneering micro-investing for Australians aged 18 to 35. In 2018, Acorns Australia rebranded as Raiz Invest.

The Ra

Improving financial literacy

Since its inception, the company has been committed to improving its customers’ financial literacy and empowering them to invest in the stock market from a young age.

New class of investors

Historically, two factors have worked against younger investors. First, they lacked knowledge about how to start investing in the stock market. Secondly, investment funds, financial advisers, and stockbrokers are interested only in clients with substantial sums to invest. By addressing both of these barriers to entry, Raiz is enabling a whole new class of investors.

Simplified investing

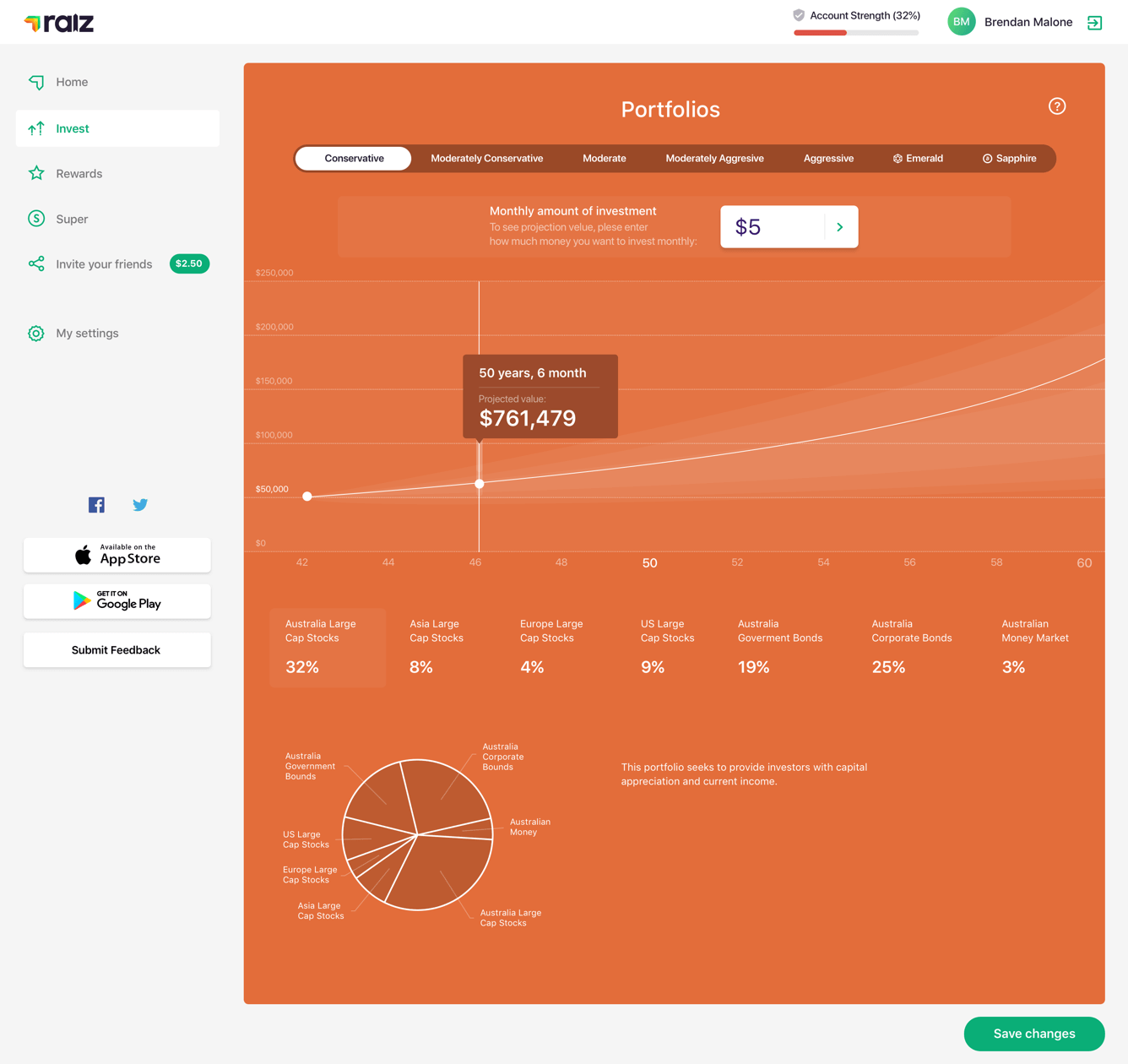

The Raiz philosophy is about disciplined saving and investing small amounts regularly. Their user-friendly automated savings and investment application uniquely links simplified investing with everyday life. Its key feature is literally empowering everyday people to invest while spending.

No minimum account balance

There’s no minimum account balance requirement to open a Raiz account, and users can gain hands-on experience on saving and investing in global markets even with very modest amounts.Round-Ups

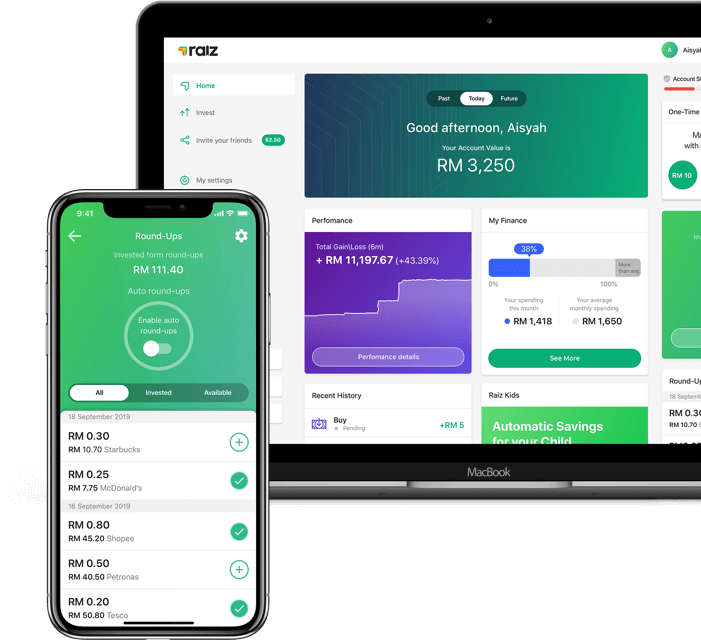

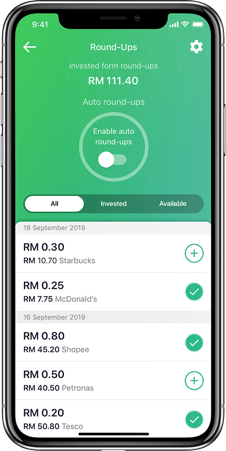

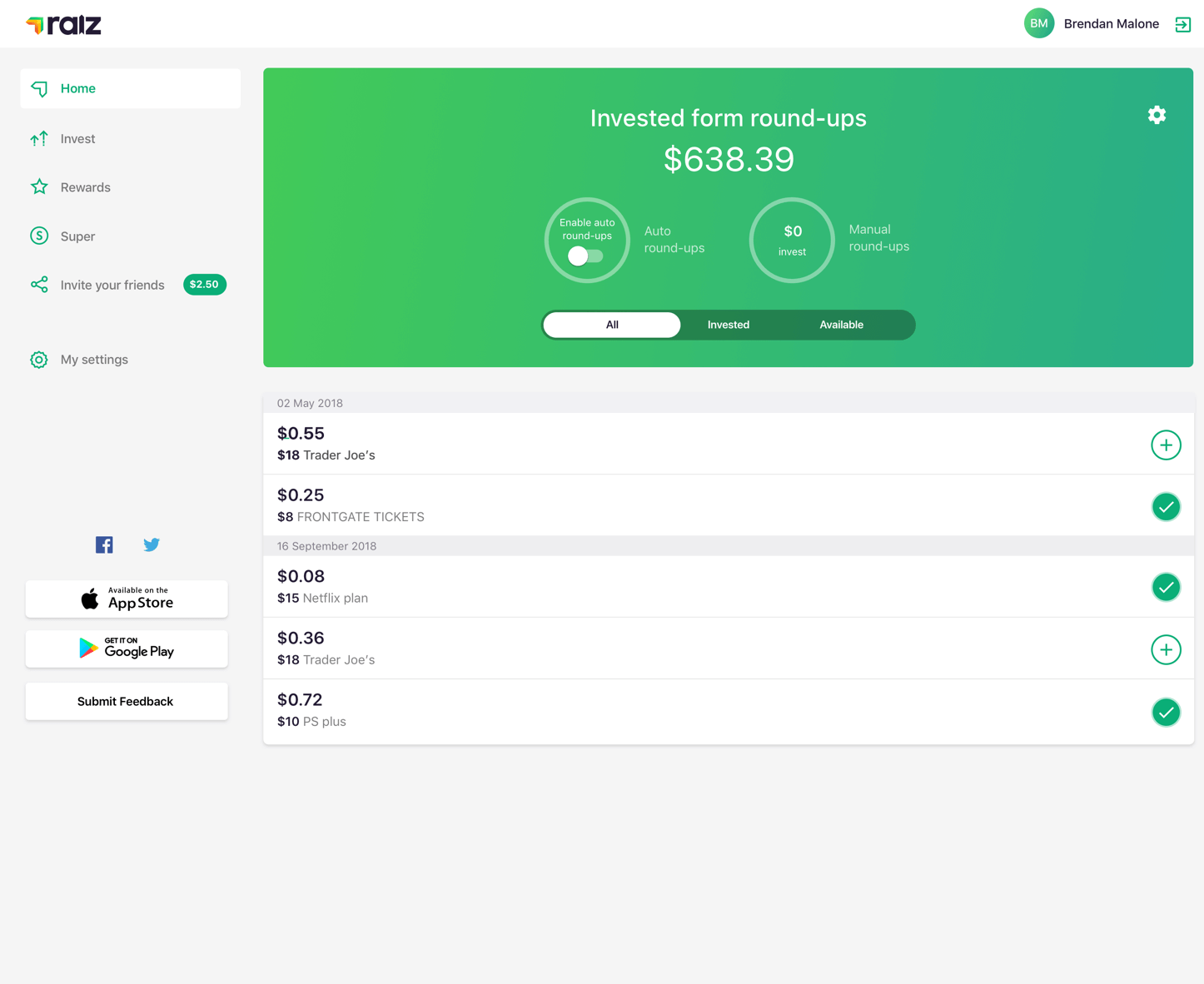

Round-Ups is the key benefit of using Raiz: it turns its users’ everyday purchases into an investment tool. Users that opt in to this feature link one or several credit/debit cards to Raiz’s funding account. After that, every time they swipe a connected card, the virtual change goes to their account to invest.

The app monitors the user’s EFTPOS transactions and rounds up the spends to the nearest dollar. If they pay $8.40 for lunch, the actual change of $0.60 they would have had is automatically allocated to their account in the app. When the accumulated virtual change reaches the AUD$5 threshold, Raiz automatically invests it into the user’s chosen ETFs.